April 11, 2024

Find out how much payment providers really cost, and make an informed decision for your business

It’s a well-acknowledged fact that eCommerce payments offer a wide range of choices. Credit and debit cards, digital payments, payment gateways that claim to do all the work for you, wire transfers, and new disruptive technologies like crypto all are competing for the attention of both merchants and consumers.

There are variable fee structures for more traditional methods, and modern digital processors such as PayPal and Stripe, with intricate pricing systems. But how do you pick?

What is right for your business? Will you find a service that can adequately be combined with your store’s in-person payments without leaving you with two separate operations and a ton of extra accounting? Payments should be the easy part of doing business, not a whole extra division of your company.

Today, we will take a closer look at aspects such as transaction fees, international charges, and potential hidden costs. When you have finished reading this article, we hope you will have a clear perspective and all the tools you need to make an informed decision that is good for you.

Before you start reading, do consider that we are using numbers that are valid for Europe at the time of the writing of this article (unless stated otherwise).

Banking and Traditional Payment Processors

Wire transfers are the most traditional and widespread payment form that’s still used today. While eCommerce may not rely on it as much for small purchases, it’s still the standard for many industries. This habitualness has allowed their fee structures to develop and become a source of complexity and unexpected costs, especially in international transactions.

Banks typically impose charges for both incoming and outgoing wire transfers. The fees can range significantly, with outgoing fees being generally higher than incoming ones. The U.S. market should be highly attractive for European and LATAM businesses. It’s by far the world’s largest and most liquid. Payments, however, often stand in the way. The U.S. is a market where bank and wire transfers are still very common, and provides clear examples of how fees can balloon: For instance, domestic wire transfer fees can average around $15 for incoming and $30 for outgoing transactions in the U.S.

But what, let’s say, would you pay if your company is based in Europe or Latin America? International wire transfers see a notable increase, with average costs rising to about $45 for outgoing transfers. $45 per sale can and will wipe out many profit margins.

The fee schedule for wire transfers is not uniform across banks, but the standard is quite clear. For example, Bank of America charges the same $45 for outgoing international transfers in USD, while Wells Fargo's fee is $45 in USD and $35 in a foreign currency. On the other end of the spectrum, banks like BMO Harris and Discover may not charge fees for incoming wires, but outgoing international wires can cost just as much: $45.

Beyond the basic transfer fees, international wire transfers often involve additional costs that can accumulate. These include exchange rate markups and correspondent bank fees. The latter refers to charges by intermediary banks in the SWIFT network, which can slow down the transfer and reduce the final amount received.

But what about PayPal and Stripe? Surely these modern mediators have made things much easier and more accessible, right?

PayPal and Stripe are trying to soften the blow

There are two giants of payment processing that seek to mediate payments and facilitate the traditional process we discussed above. Their goal is to make things cheaper, safer, and easier on everyone.

Instead of charging fixed fees, like we discussed above, their payment structures tend to be more layered and complex.

At the end of the day, however, do they provide significant savings for businesses?

PayPal's fee system is a blend of percentage-based and fixed costs. There is a standard international fee for all transfers, plus applicable domestic transfer fees and currency conversion fees. This makes PayPal's fee structure somewhat variable. At worst, however, for cross-border transactions, PayPal charges a fee of 5% (with a minimum of 1.99 EUR and a maximum of 3.99 EUR), and an additional 3% on top of the base rate for currency exchanges. This can mean up to 8% of the total value of the purchase.

Stripe maintains a more predictable fee model for international transactions. They have, however, recently increased their prices, which can now go up to 3.25% + €0.25 per transaction.

Stripe, however, applies fees to each payment rather than each sale. For instance, if a customer splits a €100 purchase into four payments of €25, the merchant pays €1.80 in fees for each €25 payment, totalling €7.20 of fees for the €100 sale.

This would put them right up there with PayPal.

Depending on your business model, you will have to study what works best, especially since neither of them offer a full gamut of payment options, taking only major cards and payment providers.

The newest tech: crypto

Cryptocurrency payment processors seek to make payments even easier and cheaper for merchants and customers alike. Blockchain technology’s unique features allow for trustless payments that cut out a number of middlemen from the process, shrinking prices and making everyone less reliant on intermediators.

Trustlessness and decentralization

Technology does most of the mediation for these currencies, with very little mediation needed from banks, financial institutions or outside processors. This means that the system is always operational, always fast, and always cheap.

Global Accessibility

Unlike traditional banking systems, which can have geographic limitations and varying regulations, cryptocurrency processors offer a more universally accessible platform. This is particularly beneficial for businesses operating internationally, as it simplifies the process of handling transactions across borders.

Security and Transparency

Transactions on the blockchain are encrypted and immutable, meaning they cannot be altered once recorded. This reduces the risk of fraud and provides a transparent transaction ledger. It makes bookkeeping tools very reliable and relatively easy to develop. And of course, if you’re relying on a partner like NAKA, settlements in fiat are always a possibility.

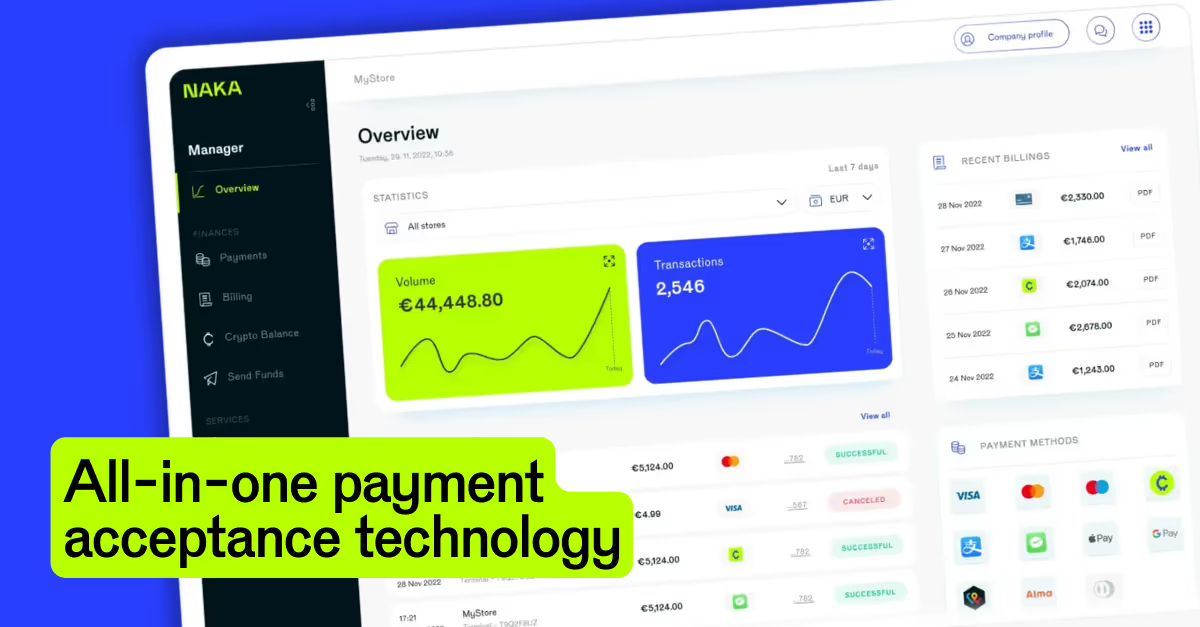

NAKA’s view: a holistic solution for all

NAKA offers a holistic payment solution designed to cater to both brick-and-mortar and online stores, ensuring adaptability to whatever types of transactions your customers prefer.

NAKA goes even further in our quest to create the single most adaptable product of all. We have developed a whitelisting program that allows your business to create its own point-of-sale solution, branded by you and using our tech.

Here’s how it works:

Crypto Payments

NAKA's platform supports payments with any crypto wallet. It supports currency-based payments like Bitcoin on Lightning and Tether on multiple blockchains, as well as wallet-based payments including Binance Pay and Bitcoin.com Wallet. Merchants can opt for instant crypto or periodic fiat settlements in their own local currency, thereby mitigating volatility concerns.

Card Payments

NAKA’s point-of-sale (POS) technology is compatible with leading card acquirers, payment applications, and schemes. This includes the NAKA, as well as any white labeled cards using our tech, ensuring comprehensive card payment support.

Digital Payments

The platform is compatible with various digital payment systems, supporting market-specific services like WeChat Pay, Alipay, Twint, Flik, mBills, Valú, and others. If you don’t recognise some of these names from where you’re based, that’s because NAKA is glad to adopt regional preferences.

Value-added services

Nevertheless, NAKA facilitates the seamless integration of an extensive array of value-added services (tipping, ePOS integrations, Crypto exchange, Gift cards), elevating your user experience to new heights.

Integration and Compatibility

NAKA’s all about a holistic payments experience, where only one company, one app, and one service suit the needs of the most people possible. This is why we made sure our solution went well beyond eCommerce.

NAKA’s solution for brick and mortar shops is mature and comprehensive as well. NAKA’s POS software can be integrated into any Android smart POS device and is compatible with any cash register system, self-checkout system, or virtually any other payment application. For eCommerce, NAKA's solution is compatible with all major platforms, offering plugins for WooCommerce, Magento, OpenCart, PrestaShop, and more. You can dive into all product specifics here.

If you have read this far and are wondering what NAKA’s fees are, we’re glad to say they’re a fraction of the competition. For FIAT settlements, our payment processing fees will be as low as 1.25%. No hidden fees, no added costs. The fees are the same no matter where your customer originates.

You can get started today.

Share this post