August 8, 2024

The trend towards cashless transactions is evident, with virtual and crypto cards increasingly being used for business and consumer needs alike.

The usage of crypto-powered debit and credit cards is expected to exceed 400 Billion USD in the next ten years. Research suggests adoption has reached cruise speed. The market is already worth 25 Billion USD, and it’s evolving at a resounding pace: CAGR of 32% through 2033. This reflects a number of circumstances, from the increased robustness of the crypto market itself to the merging of digital asset flexibility with conventional spending behaviors.

In short, cards now have capabilities they didn’t before, much thanks to crypto. Some have become exceptionally versatile. Some are even EMV-compatible, which means they can be accepted by participating merchants anywhere in the world, while providing liquidity to any kinds of assets (digital and tokenised) without the need for a prior relationship with any financial institution. This kind of features would inevitably lead to customer behavior changing.

These changes are leading traction notably among younger demographics, who value the immediacy and seamlessness provided by such digital solutions. Let’s take a look at the broader movements that are driving this growth.

Global Trends in Payment Card Usage

The first statistic that immediately pops up: we are going cashless. It’s not just crypto cards that are making waves, it’s virtual cards as well. Cash payments now represent under 20% of payments in the US, and every year that number lowers.

The integration of crypto cards into the global market showcases a shift from cash towards digital currency acceptance. According to VISA’s numbers alone, $2.5 Billion were spent using these cards globally in the first quarter of 2022 alone. This represents over 70% of the entire previous year.

Virtual cards, crypto or otherwise, are growing at a very powerful rate as well. In 2023, the total volume of virtual card transactions amounted to $36 Billion. This number is expected to grow almost 400% in the next five years.

In fact, the global Web3 market is expected to reach USD 81.5 Billion in 2030, a market growth with a CAGR of 43.7% according to Emergen Research. Regional crypto payment trends help us understand why and how card payments can have the most fertile ground to grow.

• Europe is taking advantage of a strong regulatory framework to support crypto innovations, making up about 18% of all crypto transactions. Eastern Europe in particular is leading all global regions in terms of growth.

• North America still leads, with over a Trillion USD transacted between June 2022 and June 2023, driven by both consumer demand and an increasing number of businesses accepting crypto transactions.

• Emerging markets in Latin America and Africa, while still developing, are rapidly adopting crypto solutions due to the lower barrier to entry compared to traditional banking systems. Large unbanked populations present an ideal use-case for blockchain-powered cards, and an analysis of the regional scene in LATAM is some of the most promising.

How We Spend with Crypto and Virtual Cards

The versatility of crypto and virtual cards has catalyzed a shift in consumer spending behaviors, increasingly blurring the lines between digital assets and traditional fiat expenditures.

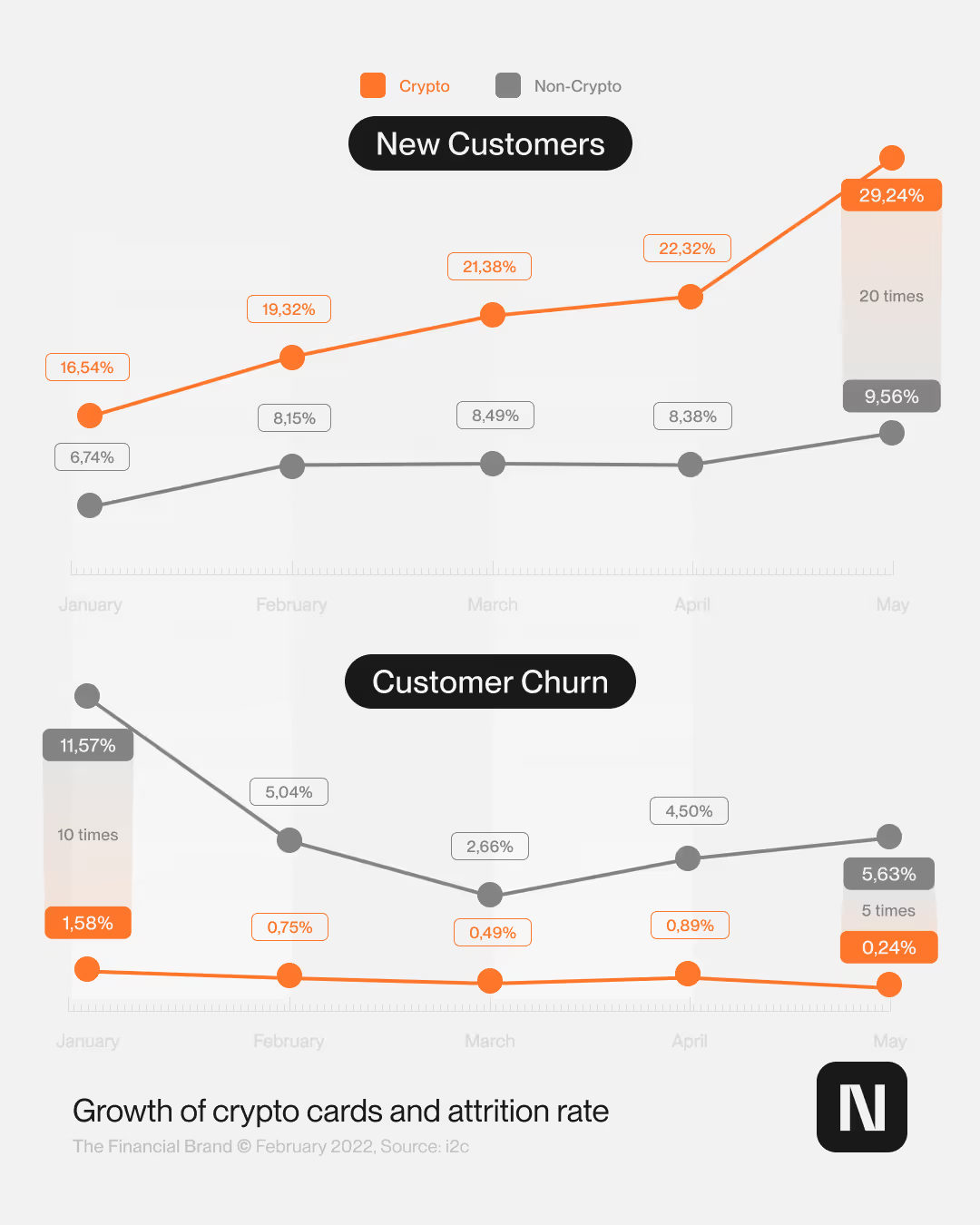

• Low Churn Rates: A notable trend in crypto card usage is how low the churn rate is. Once people start using them, they don’t stop. In contrast, the churn rates for non-crypto cards are 10 times higher in some periods.

• Healthcare and Finance Are Leading the Way: Virtual card usage has grown right alongside crypto. Studies indicate that some of the most significant spending we do is driving their growth. Several million healthcare and finance firms are expected to be using them by 2030.

• Businesses Love Virtual Cards: While consumer usage is expected to grow at a very healthy pace, business usage still amounts to almost 70% of all transactions using virtual cards.

• Demographic Insights: The adoption spans various demographics, but younger consumers, particularly millennials and Gen Z, are the most avid users, likely due to their familiarity with digital technology and openness to new financial tools.

These behaviors are supported by the dual benefits of these cards: the security and privacy of cryptocurrency transactions, coupled with the convenience and familiarity of traditional card usage even in the digital realm. With technology like the NAKA Card, users can even now tokenise their illiquid assets, accessing instant liquidity without having to sell and expose themselves to inflation. This blend is proving pivotal in driving forward the integration of cryptocurrencies into mainstream commerce.

Integration of Crypto and Traditional Card Payments

As financial landscapes evolve, the integration of cryptocurrency with traditional card payments is not just an innovation—it’s becoming a necessity. This fusion caters to the growing consumer demand for versatile payment solutions that accommodate both digital and conventional currencies under one system.

In practice, this integration involves sophisticated technology that allows transactions to be processed in either crypto or fiat currencies without manual intervention by the user. For consumers, this means the flexibility to choose their currency at the point of sale depending on their preference or financial advantage—be it crypto for its potential investment returns or fiat for its stability. Merchants benefit significantly from this arrangement as well. The ability to accept both forms of payment without needing separate processing systems simplifies operations and broadens their customer base. This is particularly advantageous in tourist-heavy areas or regions with significant international business where currency variety can often be a barrier to sales.

From a regulatory perspective, this hybrid model presents unique challenges but also opportunities for clearer, more comprehensive frameworks that can better address the nuances of modern financial transactions. As regulations evolve to catch up with technological advancements, the potential for widespread adoption of these integrated payment systems grows, promising a more inclusive and efficient global marketplace.

This ongoing integration marks a significant shift in how transactions are conducted, reflecting broader economic trends towards globalization and digitization, and underscoring the critical role of adaptability in the future of commerce.

Despite the challenges, the future of crypto and virtual cards appears to be clearly intertwined.

If you are interested in issuing the most versatile non-custodian card on the market, we can help.

Share this post