December 22, 2025

Explore how blockchain infrastructure is eliminating the banking stack that used to be mandatory for card programs

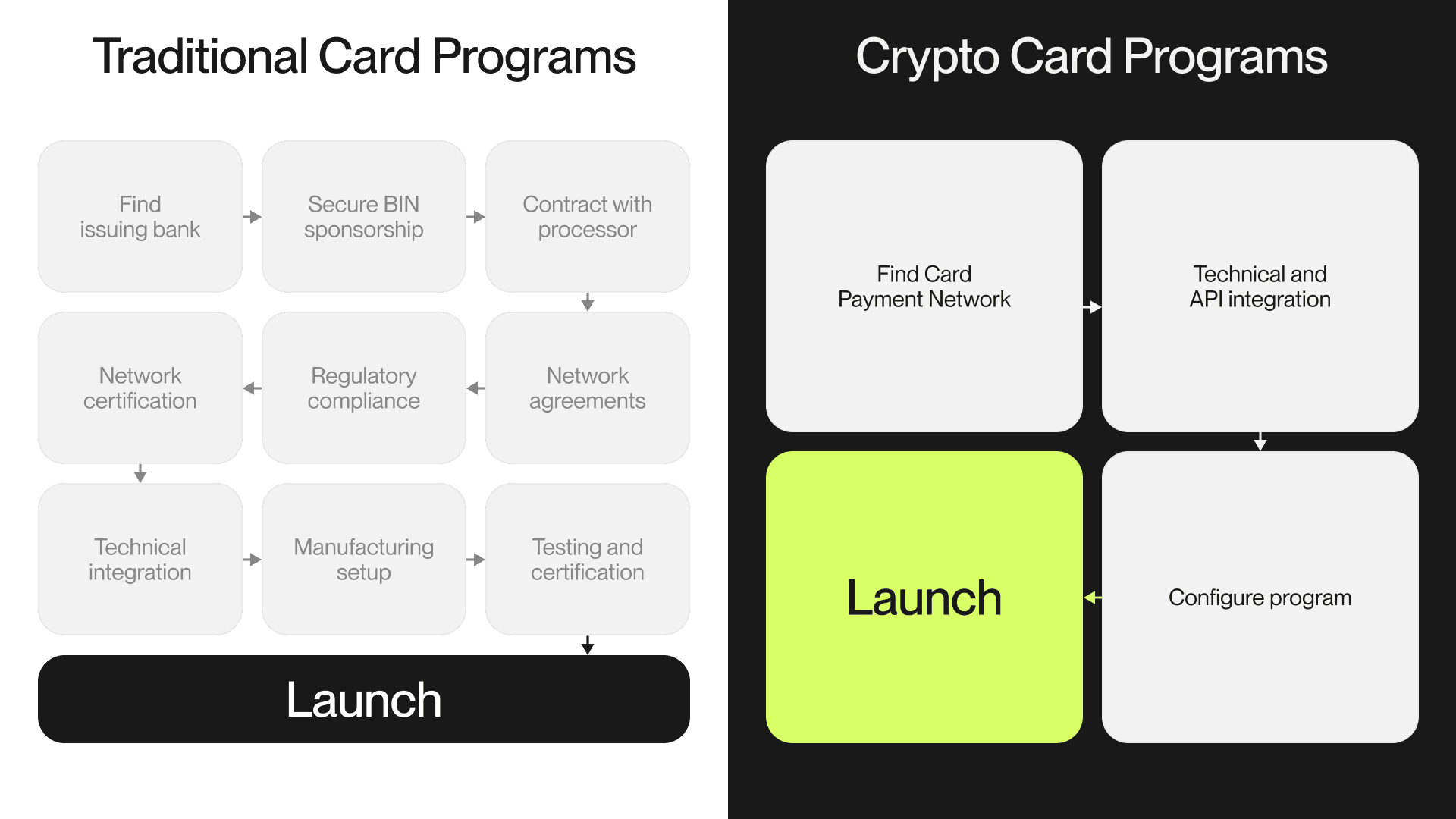

Companies typically spent 12 to 36 months securing issuing bank partnerships or licenses, completing Visa or Mastercard approvals, integrating processors, implementing compliance frameworks, and coordinating audits, testing, and certifications. Even when everything went smoothly, 18 months was considered fast, and this was before meaningful user acquisition or revenue generation began.

Financially, the burden was substantial. Upfront costs regularly reached millions of euros, while additional capital had to be locked into reserves and prefunded accounts to satisfy banking and network requirements. At the same time, senior teams were forced to spend months managing legal negotiations, compliance reviews, and operational dependencies instead of focusing on product-market fit, distribution, or customer growth.

For most businesses, the opportunity cost of this model exceeded the direct financial cost, because speed to market and flexibility were sacrificed long before the product reached users.

Who the Legacy Model Actually Served

The traditional card issuing model was built to serve banks and large financial institutions whose operating structures, balance sheets, and regulatory mandates aligned with centralized, slow-moving infrastructure.

It worked reasonably well for licensed banks, national financial institutions, and large corporations launching card programs as secondary products, such as airline mileage cards or retail co-branded cards, where long timelines and limited customization were acceptable tradeoffs.

It worked poorly for startups, fintechs, digital platforms, and businesses operating across borders or in emerging markets, where speed, cost efficiency, and adaptability were critical. In these cases, success depended less on product quality and more on whether the business fit neatly into a bank’s internal risk appetite, geographic priorities, and commercial incentives.

In practice, many viable businesses were delayed or blocked entirely, not because their products were unsafe or unworkable, but because they did not align with how banks preferred to operate.

Why the Legacy Model No Longer Makes Business Sense

Modern payment requirements are straightforward: businesses need global acceptance, reliable compliance, predictable costs, fast settlement, and a user experience that matches modern expectations.

The assumptions that justified the old model have changed. Businesses no longer benefit from banking hours, multi-layered intermediaries, capital locked in reserve accounts, or year-long integration timelines that delay revenue and market validation.

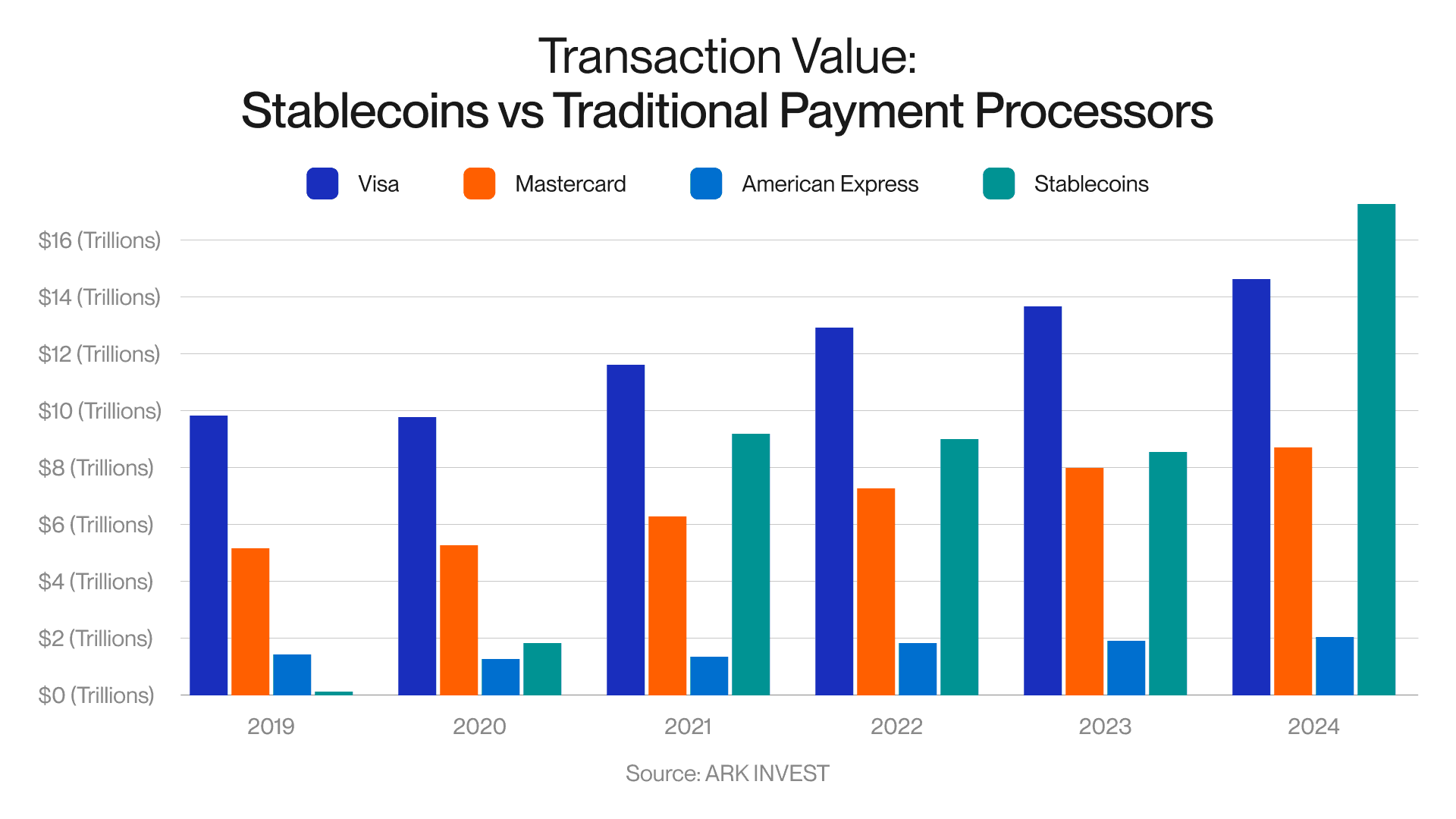

Settlement no longer needs to stop on weekends or wait for banking windows to reopen. Value can move continuously, with transparency and traceability built into the infrastructure. Compliance can be embedded into the system rather than managed through fragmented vendor relationships and manual oversight. Card networks now work directly with infrastructure providers that handle compliance at the system level rather than forcing each issuer to rebuild the same stack.

Stablecoins turns out to be particularly important here. They create a form of digital value that can move seamlessly on-chain while still integrating with traditional payment rails, which solves a problem that had been blocking innovation for years. Now, settlement can happen instantly, custody can stay with users, and card programs can launch without spending months negotiating reserve requirements. The infrastructure stack that had always meant banking partnerships now has a genuine alternative, and that alternative is considerably faster and more flexible.

It’s 2025, and for a long time it was easier to build the Empire State Building than to launch a card program.

Not because the technology was difficult - but because of one rule the industry never questioned: if you wanted to issue cards, you needed banks. Not just as partners, but as gatekeepers to everything: technology, compliance, settlement, and access to card networks.

That rule shaped the entire payment industry.

The Cost of the Legacy Issuing Model

Under the traditional (old) model, launching a card program required a combination of long timelines, high upfront costs, and ongoing operational commitments that most non-bank businesses were never designed to handle.

This changes the economics of issuing cards. Instead of assembling a complex network of banks, processors, compliance providers, and manufacturers, businesses can now integrate with infrastructure that already handles these requirements as part of a unified system.

As a result, the legacy approach is no longer safer or more responsible; it is slower, more expensive, and operationally inefficient.

Custom crypto-backed, Visa compliant card program

NAKA was designed specifically to remove the banking layer from card issuance while remaining fully compatible with the existing payment ecosystem.

When a business integrates with NAKA, it connects to infrastructure that is already EMV-compatible, already connected to Visa’s global acceptance network, and already compliant by design. There is no need to negotiate issuing-bank partnerships, build custom processor integrations, or meet capital requirements before validating demand.

From the user’s perspective, the card works like any other Visa card at over 150 million locations worldwide. The difference is in how the system operates behind the scenes. Settlement happens on-chain rather than through legacy banking rails, and self-custody is built into the architecture rather than added as a special feature.

Businesses retain control over branding, user experience, and product logic, while the infrastructure layer handles settlement, compliance, and network connectivity as a service rather than a long-term operational burden.

The timeline difference is material. What historically required up to eighteen months can now be achieved in weeks, allowing companies to launch, test, and iterate without committing to a multi-year infrastructure build.

Capital, Time, and Accountability

For most business owners, card issuance is not the core product. It is an enabling capability meant to support distribution, retention, or monetization.

When issuing cards requires building banking infrastructure, the company is forced to take on responsibilities that are unrelated to its actual business: managing regulatory dependencies, coordinating multiple vendors, locking capital into reserves, and operating within timelines set by external institutions. This shifts management attention away from customers and toward infrastructure maintenance.

Modern issuing infrastructure changes that responsibility boundary. Instead of owning and operating a banking stack, businesses consume it as infrastructure, with compliance, settlement, and network connectivity handled at the system level. This is not a technological preference. It is a management choice about what the company should own versus what it should outsource.

In practice, the companies adopting modern issuing models are not trying to disrupt payments. They are trying to run more focused businesses, with clearer accountability, fewer operational dependencies, and infrastructure that scales with demand rather than limiting it.

For business owners, the decision is no longer about whether legacy issuing still works. It is about whether owning banking complexity is still a responsible use of management time and capital.

If you are evaluating card issuance as part of your product, you can learn more here.

Share this post