February 2, 2026

From the stage to the streets of San Salvador, self-custodial infrastructure moved from concept to high-volume operational reality.

While El Salvador has served as a national testing ground for Bitcoin since 2021, the Plan ₿ Forum 2026 provided a concentrated environment to showcase the collective results of practical implementation from across the industry, highlighting the infrastructure and roadmaps of NAKA and the many global organizations building within the country.

As a Silver Sponsor, this marked NAKA's second consecutive year of official participation in the forum. The event took place against the backdrop of a unique economic landscape; since 2021, El Salvador has utilized Bitcoin as legal tender to address systemic infrastructure challenges. With remittances accounting for approximately 24% of the national GDP and traditional processors historically charging between 5% and 7% in fees, the demand for efficient, low-cost settlement layers is a matter of national economic priority.

With more than 3,000 attendees gathered at the Marte Museum, the forum provided a perfect platform to demonstrate the NAKA+ Visa Platinum Card and the broader NAKA ecosystem. The objective was to validate self-custodial spending within a country where decentralized payments are already integrated into public policy and daily commerce.

Strategic Analysis: Payment Evolution in Latin America

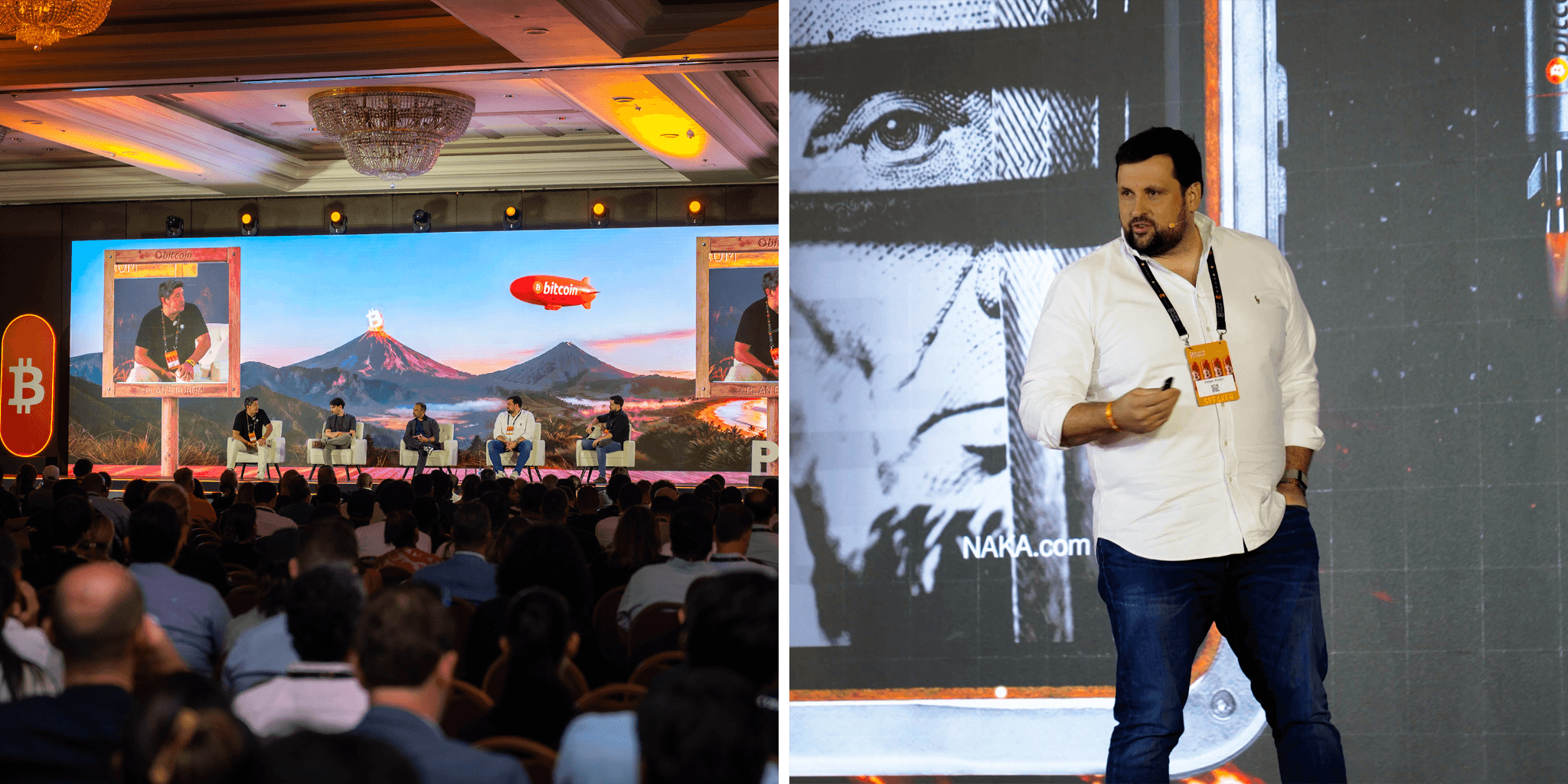

On January 30th, NAKA Founder & CEO Dejan Roljic participated in a panel discussion alongside leaders from SmartPay, Muun, Paytastand, and Simply Bitcoin. The session focused on the evolution of global payment trends and the specific role of the Latin American market in driving these shifts. The panel concluded that the regional market is no longer in a phase of theoretical adoption but is actively building infrastructure based on real user requirements and high-frequency payment flows.

On the morning of January 31st, Roljic delivered a keynote on the WAGMI stage titled "Who Owns Money Now?" The presentation analyzed the psychological and technical factors influencing self-custody. Roljic addressed the "technology gap" that often occurs when users outsource financial trust to institutions to avoid the perceived complexity of personal responsibility.

A central theme of the keynote was the distinction between responsibility and accountability. Roljic argued that while financial networks can manage the responsibility of transaction execution, true asset ownership requires the user to retain accountability.

To make this distinction tangible, he introduced the Ownership Test, a practical framework used to evaluate the sovereignty of digital assets based on eight criteria. The test encourages people to ask critical questions:

Do you exclusively control the private keys? Can you transact without third-party approval or the risk of a freeze? Can you exit the system at any time with your value intact?

The framework clarifies the vital difference between access and ownership. While stablecoins offer the speed and liquidity required for modern commerce, the keynote underscored that self-custody remains the only mechanism for ensuring genuine ownership in an unpredictable regulatory and technological landscape

Operational Implementation: NAKA and bizz

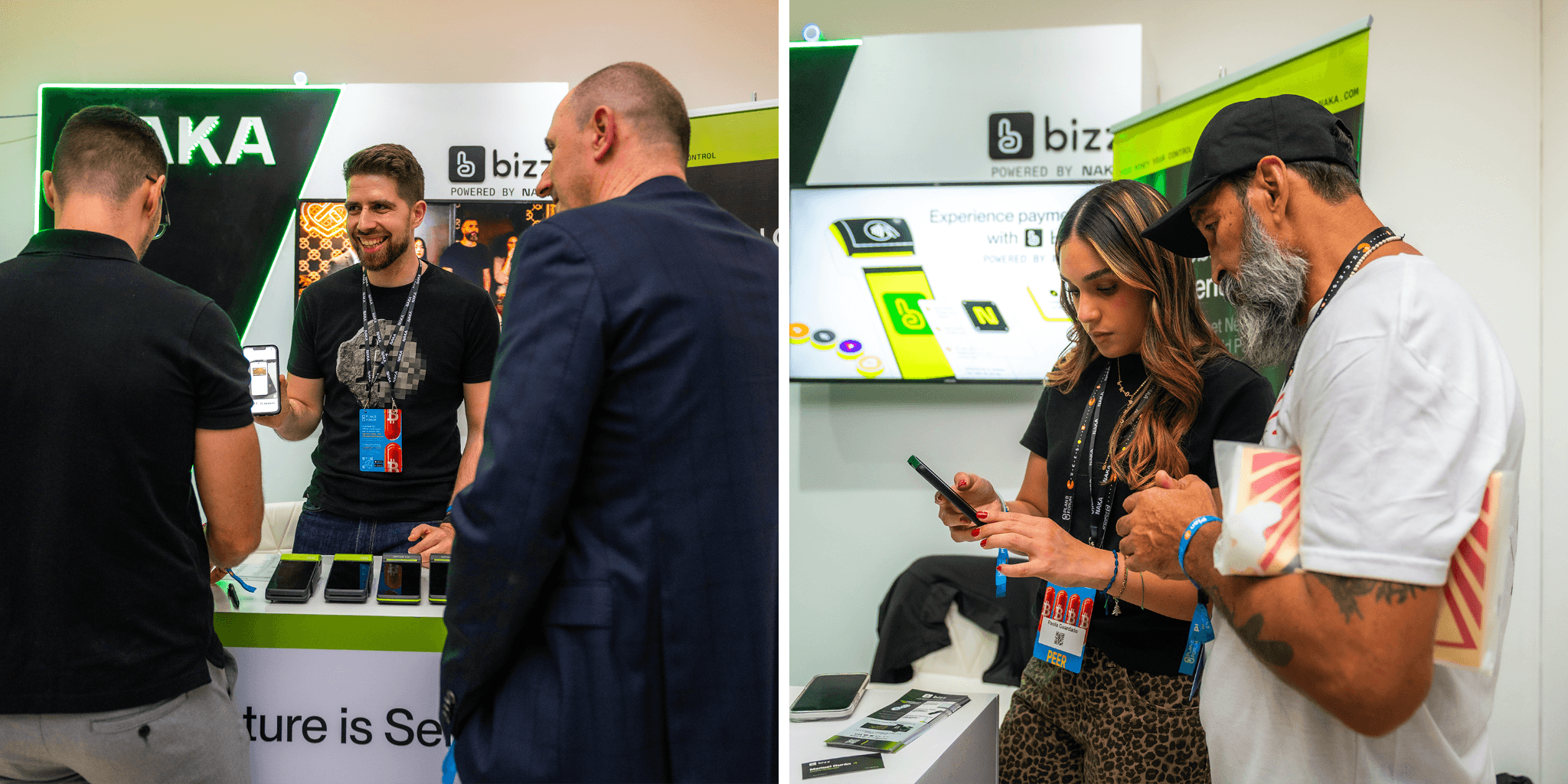

The NAKA booth in Salon 3 functioned as a live demonstration of the NAKA Payment Network in partnership with bizz (formerly Teip). As NAKA’s parent company, bizz is a holistic payment platform operating in El Salvador that simplifies business operations through integrated management tools and payment solutions. By utilizing bizz’s specialized POS devices, attendees experienced the complete payment lifecycle, confirming that unified hardware can bridge the gap between traditional commerce and self-custodial infrastructure to support sustainable business growth.

The facility enabled attendees to experience the complete payment lifecycle across two primary functions:

Issuing and Onboarding: Visitors utilized the NAKA Pay+ app to complete a streamlined KYC process. Upon verification, accounts were credited with a 5 USDT top-up, allowing users to evaluate the requirements for launching and managing self-custodial card programs.

Acquiring and Settlement: Users performed symbolic 1 USDT payments for merchandise via bizz POS terminals. This documented the speed, reliability, and transparency of the settlement layer in a high-traffic environment.

Proceeds from these transactions are being allocated to upcoming social initiatives in El Salvador, continuing NAKA’s tradition of regional support. This follow-up activity builds on our previous community commitments, such as the cleanup of Playa El Cocal and our support for Albergue Adventista, a facility providing vital housing for families of children at Hospital Bloom. We link our technical progress to social initiatives, ensuring the growth of our ecosystem directly supports local community development in El Salvador.

Self-custodial payments in action

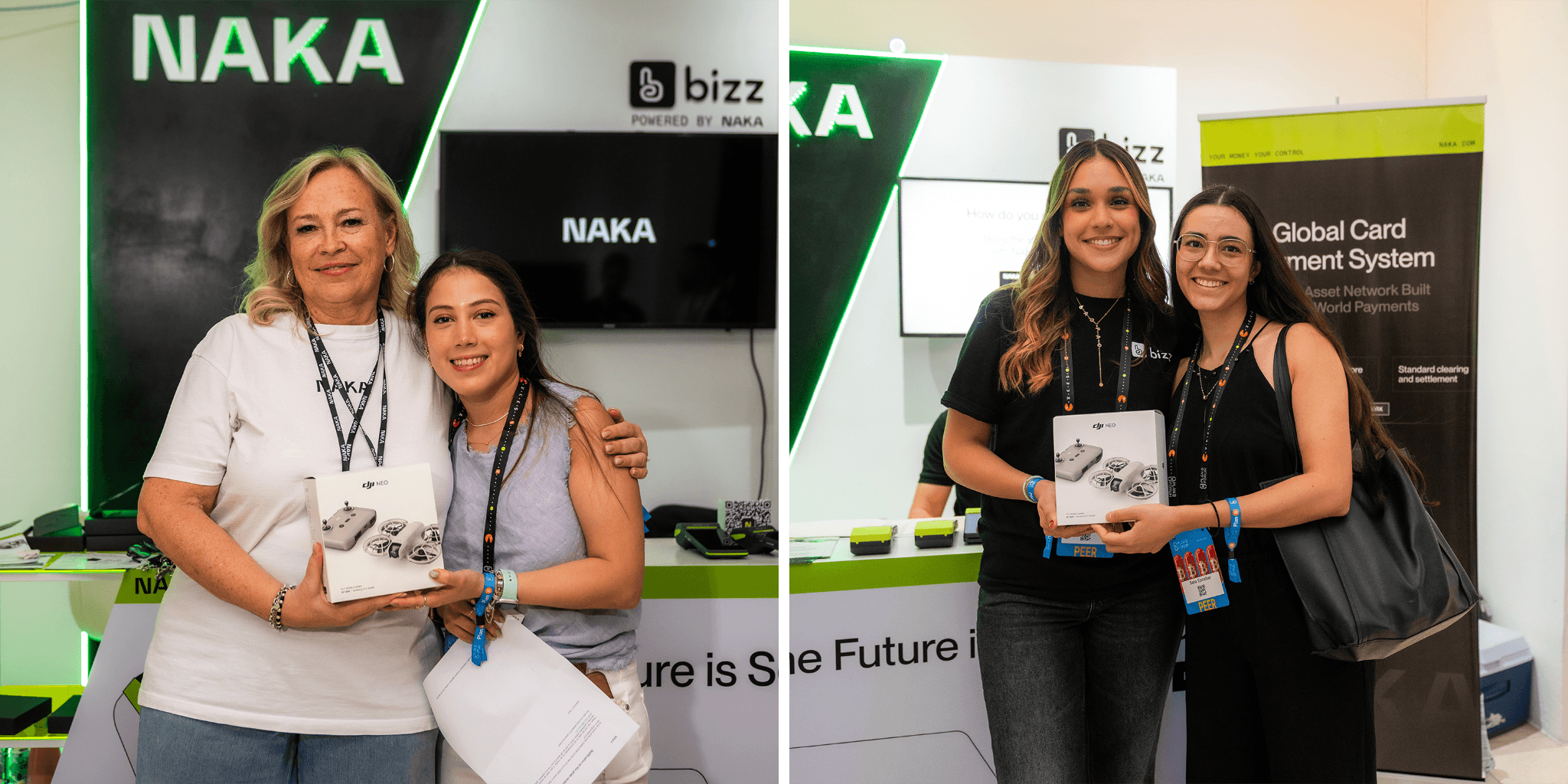

The NAKA+ Visa Platinum Card continued to demonstrate its seamless integration into daily commerce, both throughout the forum venue and across the city of San Salvador. To celebrate this widespread adoption, NAKA launched the Pay2Play Prize draw to gamify the payment experience. Attendees were encouraged to use their NAKA cards for high-frequency daily purchases, with each transaction slip serving as an entry into a raffle. This initiative wasn't about research, but about rewarding the community for actively using crypto-enabled payments in their everyday lives. Over the course of the event, two DJI Neo Drones were awarded to participants who embraced the speed and reliability of the NAKA ecosystem

Regional Operations and Strategic Presence

NAKA’s participation in the Forum reflects a long-term commitment to the region, supported by our permanent operational office in San Salvador. The 2026 forum demonstrated that user-owned finance has transitioned from an experimental phase to an operational reality.

With a strong and growing focus on Latin America, we are calling on businesses across the region to explore the NAKA Payment Network. Our self-custodial card solution allows companies to offer global payment capabilities, accepted at over 150 million locations worldwide, while ensuring users retain total control of their assets. By bridging decentralized funds with global payment rails, NAKA is providing the infrastructure for a more transparent and accessible financial ecosystem in LATAM.

Share this post