March 4, 2025

Understand how Visa and Mastercard shaped the system to keep control, and what it takes to break free

Visa and Mastercard have set the rules years ago, and everyone else pays the price.

For decades, the duopoly of payment networks has dictated the rules of payments by shaping the infrastructure itself. The dominance is about controlling the very rails that all financial transactions must pass through. The result? A system where businesses, regardless of size, have no alternative but to accept their terms. To process payments, you either adhere to their terms or find your business excluded from the system entirely.

At the Plan ₿ Forum 2025 in El Salvador, Dejan Roljic, NAKA’s founder & CEO, highlighted the scale of the problem, and made it clear why fighting back is both necessary and possible.

He opened his speech with a powerful video: a courtroom scene where Visa and Mastercard executives faced intense questioning about their market control, exorbitant fees, and the favoritism shown to large corporations at the expense of small businesses.

“If you want to beat these guys, you must be crazy, lunatic, or simply have nothing to lose,” Dejan said, to emphasize the sheer scale of the challenge.“We have nothing to lose, and we are lunatic.” NAKA isn’t just challenging the status quo for the sake of it, we’re building an alternative where businesses aren’t forced into a system designed to keep them dependent. Breaking the old payment structure requires bold actions, and that’s exactly what we’re here to do.

It’s a fight worth taking. But it won’t be won by playing within their system, it will be won by changing the system entirely.

Visa & Mastercard’s Hidden Control Over Payments

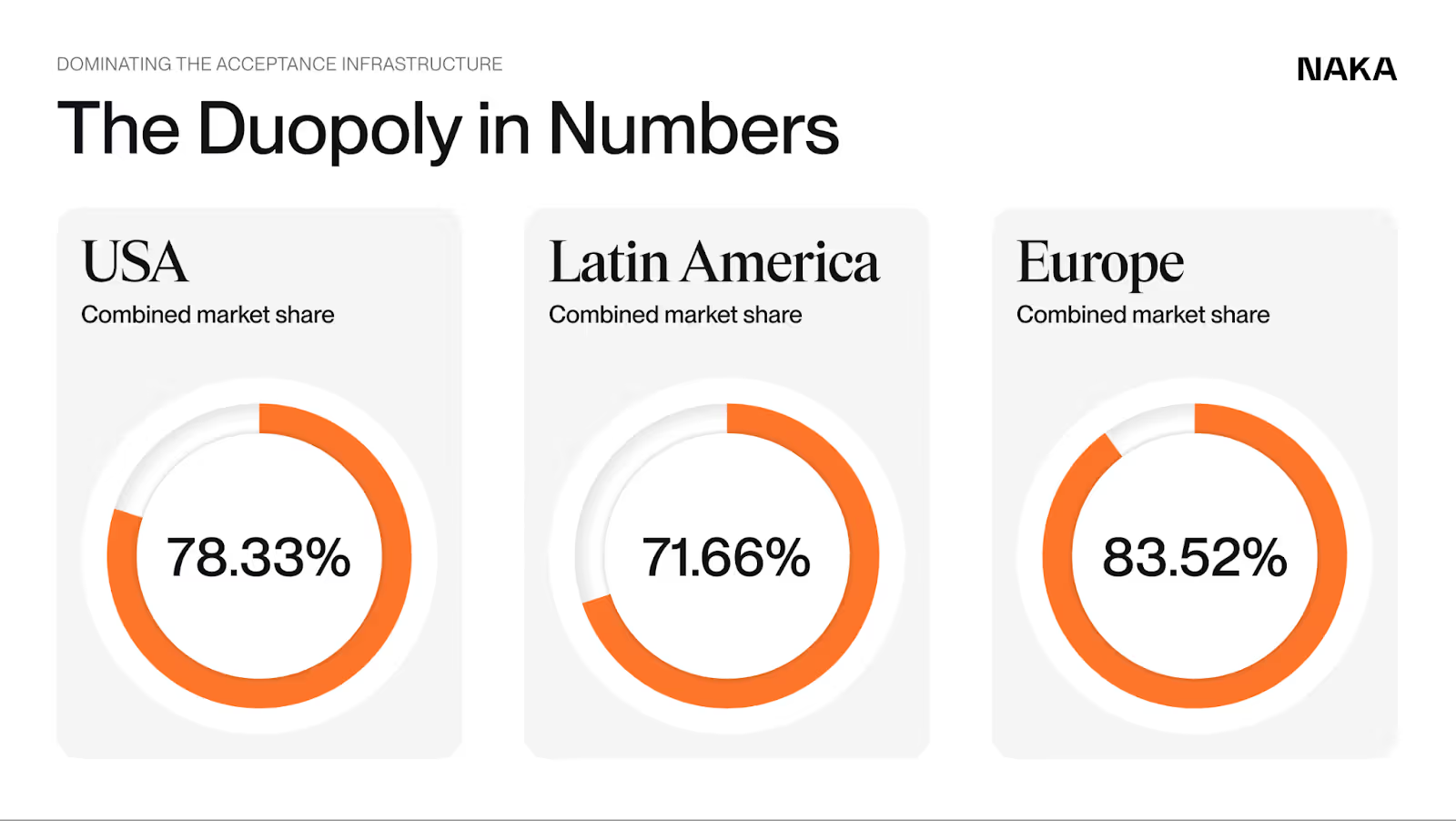

Most businesses don’t realize just how entrenched the control of the dominant card networks truly is. Their dominance isn’t merely about branding or market share—it’s the result of being the only viable option for decades. They didn’t just participate in the growth of digital payments; they built the infrastructure, wrote the rules, and positioned themselves as gatekeepers. Today, they control nearly 80% of the USA market, with influence extending across the globe.

Their reach goes further than credit and debit cards; every payment processor, every acquiring bank, and the majority of merchant terminals, everything operates on a framework they designed. Even competitors (American Express, Diners Club, and major banks) operate on Visa and Mastercard’s infrastructure. The entire payment ecosystem is engineered to ensure no real alternatives exist

Merchants aren’t willingly paying high fees. They’re paying because, for decades, there was no other way to accept payments at scale. Even the rare businesses that attempt to circumvent Visa and Mastercard through direct bank transfers or crypto payments eventually face a bottleneck: customers expect to pay with cards. And those cards, without exception, lead back to the same two giants.

Why Lower Fees Won’t Break the Duopoly

Visa and Mastercard’s 50%+ profit margins come from an ironclad business model:

1. They charge merchants high interchange fees.

2. They set the infrastructure rules so that no other payments can bypass them.

3. They partner with banks, ensuring that even if merchants wanted to break away, they couldn’t.

So, why don’t businesses just switch to a lower-fee provider? Because offering the same service with slightly lower fees isn’t enough to disrupt the system.

“You won’t disrupt Visa and Mastercard by offering the same thing, slightly cheaper. That’s not a revolution, that’s a discount.”

And that’s why most “challengers” never succeed. They compete on cost instead of reinventing the system. To break this duopoly, the financial model itself has to be rewritten.

What Does Real Disruption Look Like?

In his speech, Dejan mentioned: “The solutions that will win aren’t the vitamins, they’re the painkillers.” A true alternative doesn’t just match Visa and Mastercard, it makes them obsolete. This means building an entirely new system, one that removes the need for legacy rails entirely.

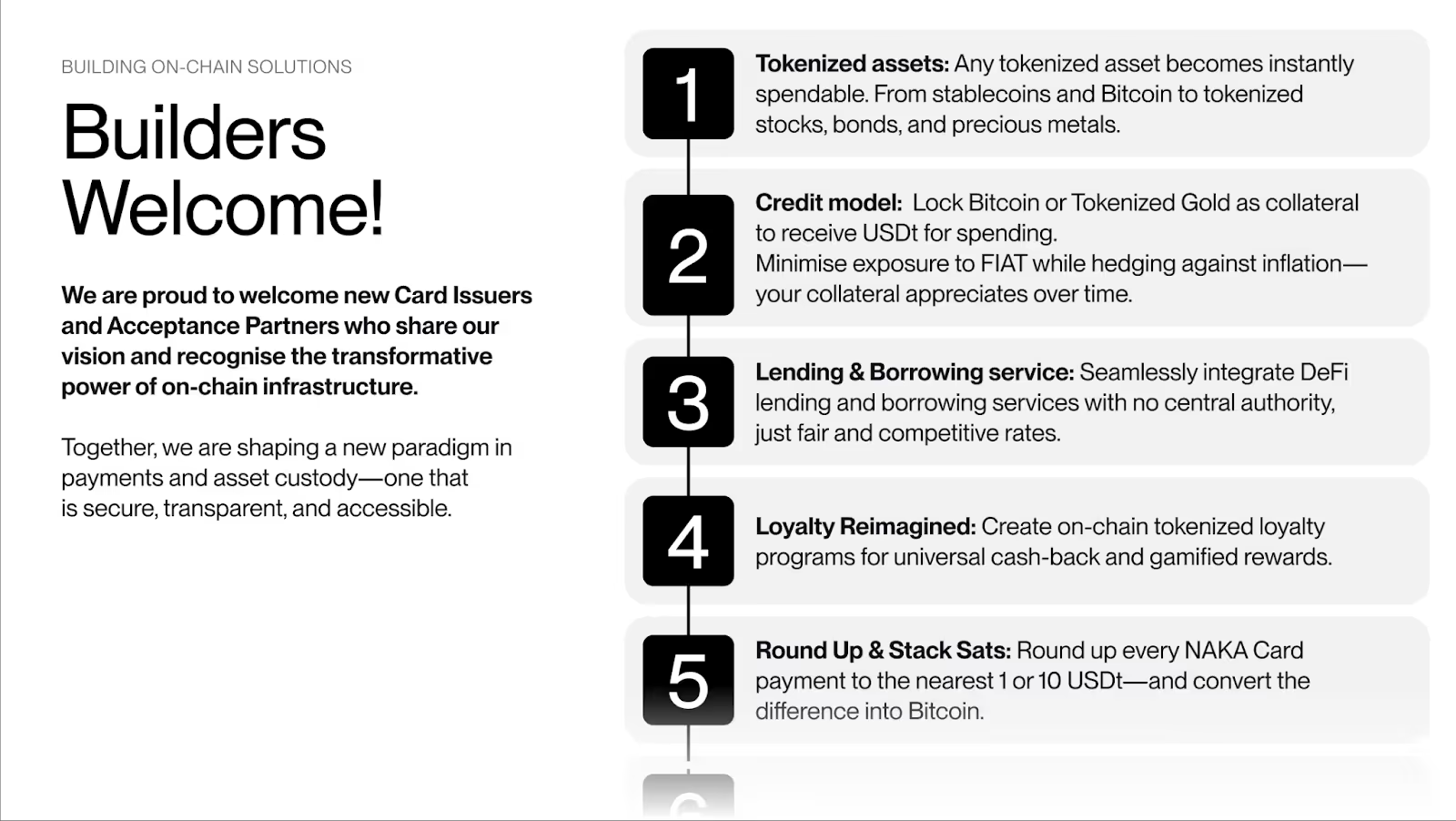

The future of payments goes beyond credit cards, it’s important to create new ways to move value without relying on legacy systems:

• Tokenized assets that function as payments, eliminating the need for intermediaries.

• Onchain credit models that offer financing without banks or centralized issuers.

• Lending and borrowing systems built directly on blockchain, cutting out financial institutions.

• Loyalty programs that offer real financial incentives, not just reward points.

None of these require Visa or Mastercard to operate. What does it really mean? It means that these features can make Visa and Mastercard irrelevant.

Why Building a Real Alternative is Important

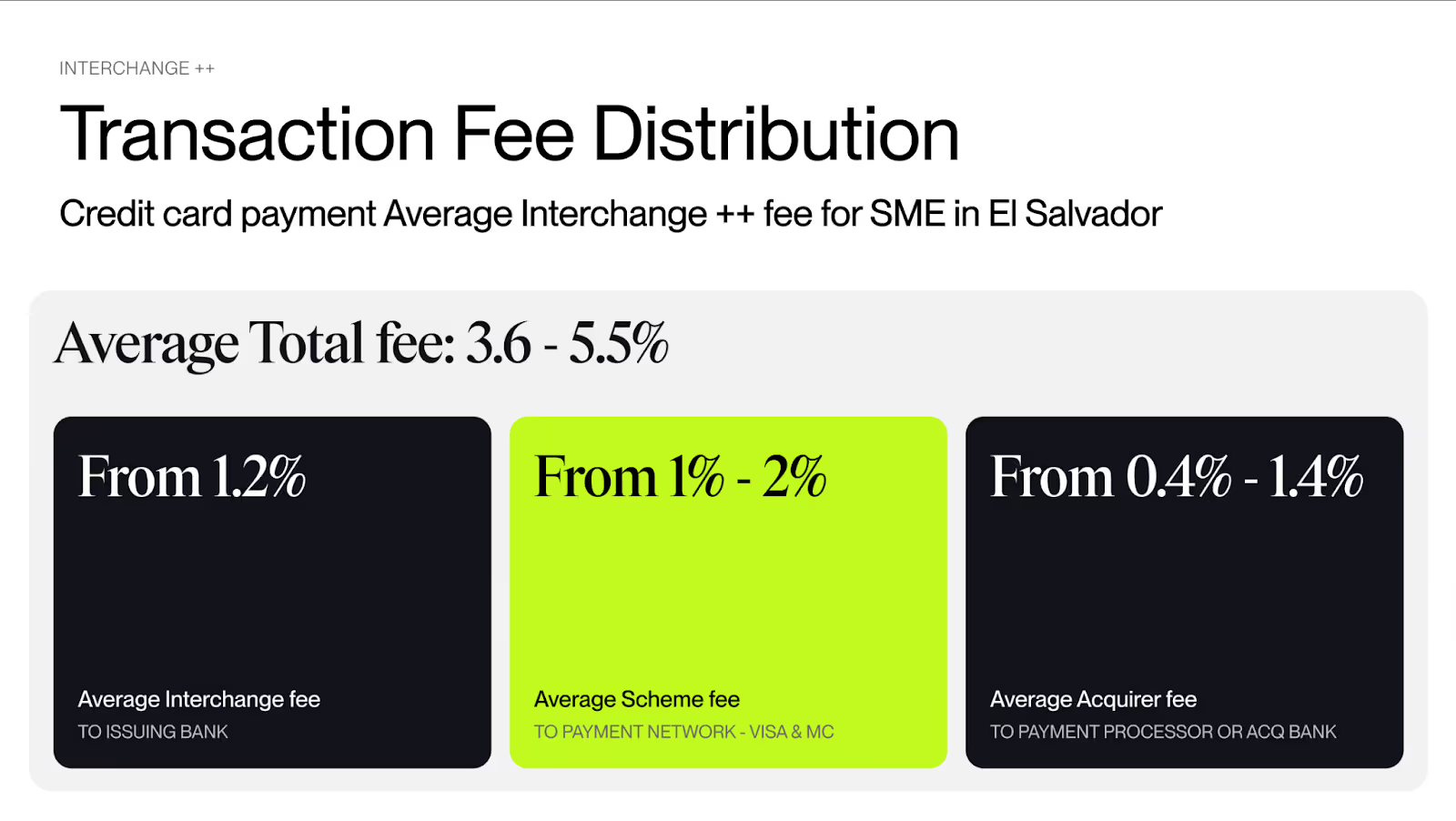

In El Salvador, merchants pay up to 5% per transaction in card fees. In many emerging markets, accepting card payments isn’t even an option because the infrastructure doesn’t exist.

“The fees aren’t capped in developing countries. If Visa and Mastercard lose revenue in the USA, they’ll raise fees elsewhere. It’s always businesses and consumers that pay.” This is the hidden cost of their duopoly. When payment networks dictate the rules, businesses have no choice but to comply, and those without access to traditional banking remain locked out entirely.

By keeping control over transactions, the old payment giants also control who gets access to financial tools and who doesn’t.

NAKA’s Role in This Shift

Visa and Mastercard’s power comes from controlling the rails. NAKA’s mission is simple: build new rails.

By creating a payment network that works outside of traditional banking, NAKA is proving that businesses don’t need to rely on legacy financial institutions to process transactions. But infrastructure alone isn’t enough. The key to adoption is making new payment methods as seamless as existing ones.

That’s what makes NAKA’s model different. The merchant experience and user experience remain identical, but instead of relying on legacy rails, transactions happen on-chain.

Disrupting Visa and Mastercard won’t happen overnight. Their market dominance is built on decades of conditioning, but all gatekeepers eventually lose control.

Here’s one last quote from Dejan: “If you’re working on solutions that will benefit the users more than Visa and Mastercard, then you’re on the right path.”

Listen to his full speech here.

Share this post