June 28, 2024

Throughout history, payments have always determined the speed and efficiency of the free exchange of goods. They are the motor of our evolution. As we learn about their history, so to do we learn about how we can move further.

Payments have transformed dramatically since the days of charge coins and paper credit. Each step in this evolution has brought us closer to a faster, more secure, and more versatile financial experience. Today, we’re witnessing the next major leap: virtual crypto cards, which combine the simplicity of traditional cards with the innovation of blockchain.

Let’s explore the evolution of payments from the very beginning, around 600 BCE.

The first ages

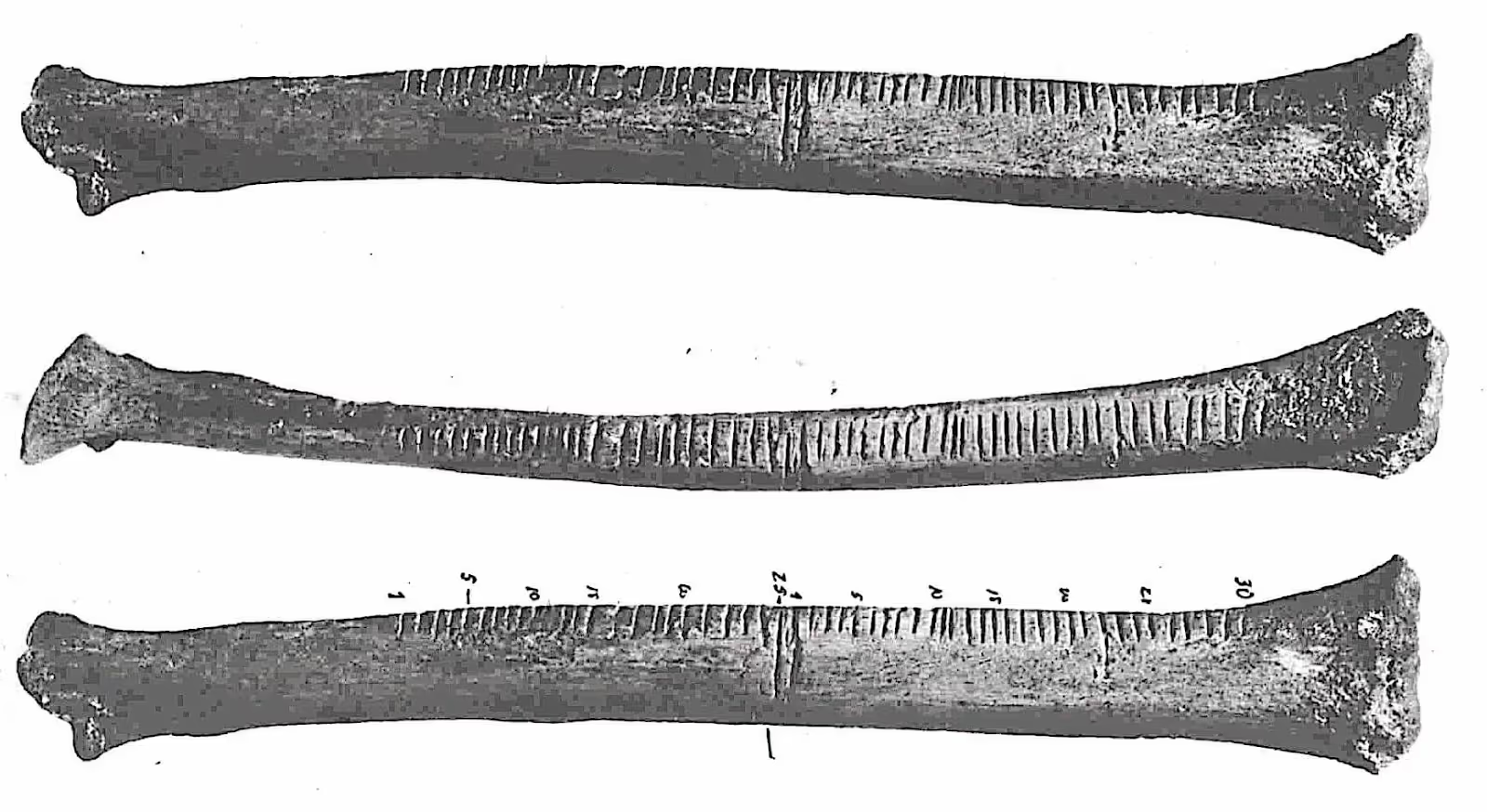

Payments are how the economy leaps forward. The transfer of value is something that humanity has been refining since currency exists, and the earliest forms of payment processing tools were little more than scratches on bone.

Fig. 1 - Paleolithic Wolf Bone Tally Stick, sourced from KASS.

Around 600 BCE, the first coins appeared in Lydia, a region in modern-day Turkey. These coins standardized value, making trade more straightforward. The use of coins spread rapidly, with the Roman Empire further refining the concept by introducing minted coins with standardized weights and values. This development laid the groundwork for more sophisticated payment systems.

By the medieval period, banking institutions began to emerge, offering more secure and efficient means of managing money. The concept of the check, introduced around the 9th century by Persian merchants, revolutionized transactions. Checks allowed individuals to transfer money without physically carrying coins or bullion, reducing the risk of theft. European banks, particularly those in Italy and the Netherlands, became pioneers in developing payment systems. By the 17th century, banks like the Bank of Amsterdam offered services that included the transfer of funds through written instructions, akin to modern checks. This period also saw the rise of promissory notes and bills of exchange, further enhancing the flexibility and security of payments.

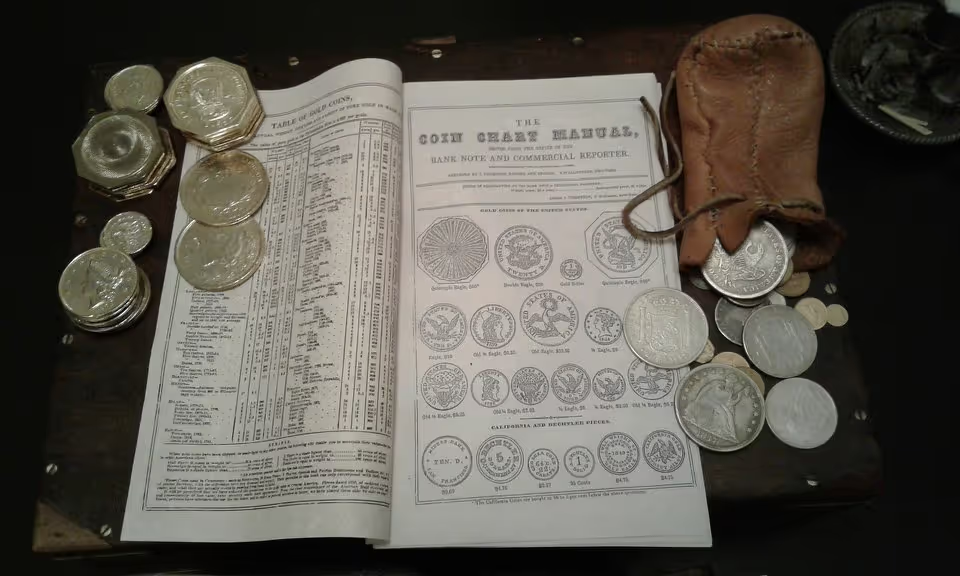

1800s: Charge Coins and Paper Credit

In the 19th century, merchants extended credit to trusted customers through coins and paper slips. Though localized and slow, this early form of credit introduced the concept of buying now and paying later, setting the foundation for a future of card-based transactions.

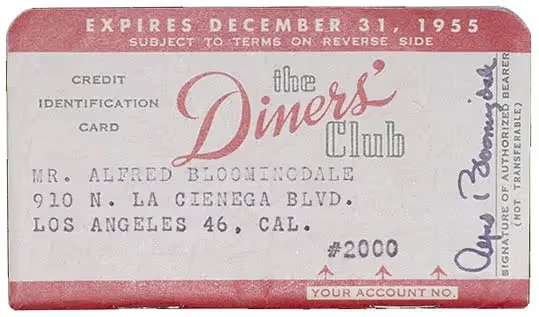

1950s: The First Charge Card (Diners Club)

In 1950, the Diners Club card was born, with 20,000 cards issued in the first year. Usable at select restaurants and hotels, it was the first card to bridge multiple businesses, paving the way for a single card serving many transactions. This innovation was followed by the launch of the BankAmericard (now Visa) and MasterCharge (now MasterCard), which extended credit facilities to a broader consumer base and provided the framework for modern credit card networks.

Fig.2 - The original Diners Club Card, sourced from the Science & Technology blog.

1960s: The First Plastic Cards

By the 1960s, plastic cards were introduced. But adoption was slow—only 1 in 7 British people had a payment card by the end of the decade. While cardholders were still a minority, the idea of portable, reusable payment tools began to gain ground.

1970s: The 10 Million Mark

The 1970s saw a boom, with 10 million payment cards issued by the decade’s end. More businesses started accepting card payments, making cards a viable alternative to cash for the first time.

The 1970s marked significant advancements in electronic payments with the establishment of the Automated Clearing House (ACH) network in the United States. ACH transfers allowed for the electronic movement of funds between banks, reducing the reliance on paper checks and streamlining the settlement process. Concurrently, wire transfers became a standard method for transferring large sums of money quickly and securely, both domestically and internationally.

ACH transfers automated the process of transferring money between bank accounts, significantly reducing processing times and errors associated with manual handling. Wire transfers, meanwhile, provided a reliable means of sending large sums of money, often internationally, in a matter of hours

As money became more flexible and payments became quicker, so too we entered our technological age. The economy was no longer strictly national. As money went global, so too did civilisation.

1980s: The Rise of Debit Cards

The 1980s marked the debut of debit cards, and their popularity surged. With 50 million debit cards issued globally, everyday purchases became easier, and card acceptance grew significantly worldwide. Debit cards were on their way to becoming a staple of modern finance.

2000s: Contactless Payments Take Off

Contactless technology revolutionized payments in the 2000s, with one in five card transactions becoming contactless by the end of the decade. Quick “tap-and-go” transactions became especially popular for small purchases, boosting the convenience of card payments.

2020s: 52% of Payments Are Card-Based

By 2021, cards accounted for 52% of all payments in the UK. With both physical and virtual cards gaining traction, digital payments have truly become the norm, setting the stage for the next evolution: crypto-enabled cards.

Today: NAKA Card Leads the Crypto Revolution

With over 500,000 transactions processed monthly in El Salvador and Lugano, the NAKA Card is at the forefront of the crypto payment revolution. Our card supports both custodial and self-custodial options, enabling secure, instant crypto payments worldwide. For NAKA, the goal is to make crypto as familiar as traditional card payments.

The Future: Crypto Payments Everywhere

Just as debit cards became essential in the 80s, crypto cards are poised to be the next standard. The shift to digital assets is inevitable, and NAKA is ready to drive this transformation, making crypto accessible for everyone.

Where NAKA Stands

At NAKA, we’re not just adapting to this evolution—we’re leading it. The NAKA products bridge traditional finance with the power of digital assets, making crypto payments as accessible as traditional cards.

As payment technology advances, NAKA’s mission is clear: to redefine the financial landscape with secure, adaptable, and easy-to-use payment solutions.

The NAKA Card offers an advanced blend of options that match today’s diverse payment needs:

Self-Custodial and Custodial Options: Users can retain full control over their assets with self-custodial options or choose custodial management for added support.

Physical and Virtual Card Options: NAKA provides both physical and virtual cards, seamlessly integrated into existing payment systems for easy adoption by businesses and users alike.

Instant and Low-Cost Transactions: Our network is optimized for real-time, low-fee transactions, allowing users to move seamlessly between fiat and crypto.

Global Acceptance: The NAKA Card can be used across multiple locations, enabling users to make crypto payments that are as simple and accessible as card payments.

From charge coins to virtual crypto cards, each step in payments evolution reflects society’s desire for more convenient and secure transactions. NAKA is proud to be a part of this journey, offering tools that go beyond just keeping up with financial trends. For businesses and individuals, our products bring the best of today’s technology into daily life, making the future of payments accessible, efficient, and secure.

Share this post